Verify — our first-of-its-kind technology, built on FedNow and RTP — verifies bank accounts in 15 seconds or less. We recently announced No Code Verify expanding access to instant bank account verification to make it straightforward to fulfill Nacha requirements. Today, we’re expanding Verify’s features again by adding the ability to check accounts for Debit Blocks, giving you the ability to know if a bank account has a debit block before attempting to pull funds.

Orum’s Debit Block provides payment certainty: You now know if a bank account is transactable and ready to be debited before pulling money from the account.

Failed payments cost the global economy over $100 billion each year, a problem Verify solves by completing bank account verification within 15 seconds. Debit Block takes this a step forward, by informing you via API when a bank account cannot be debited.

What Is A Debit Block?

A debit block prevents an ACH debit from occurring from a bank account. It was designed as a form of fraud prevention to help protect bank accounts from unauthorized transactions. Typically, these accounts specify who can pull money out. If you’re not on the authorized list, your payment request gets blocked, often leading to unexpected fees.

On the surface, this sounds great. But for anyone working in payment operations, you know the resources and time that’s required to work with customers to remedy a debit block situation. You’ve already gotten an ACH return and now you have to spend valuable time working with the customer on instructing their bank to remove the block.

Orum's Debit Block Detection Reduces ACH Returns

Our new debit restriction endpoint informs you when a bank account cannot be debited — prior to attempting to pull funds from the account — due to common ACH return codes.

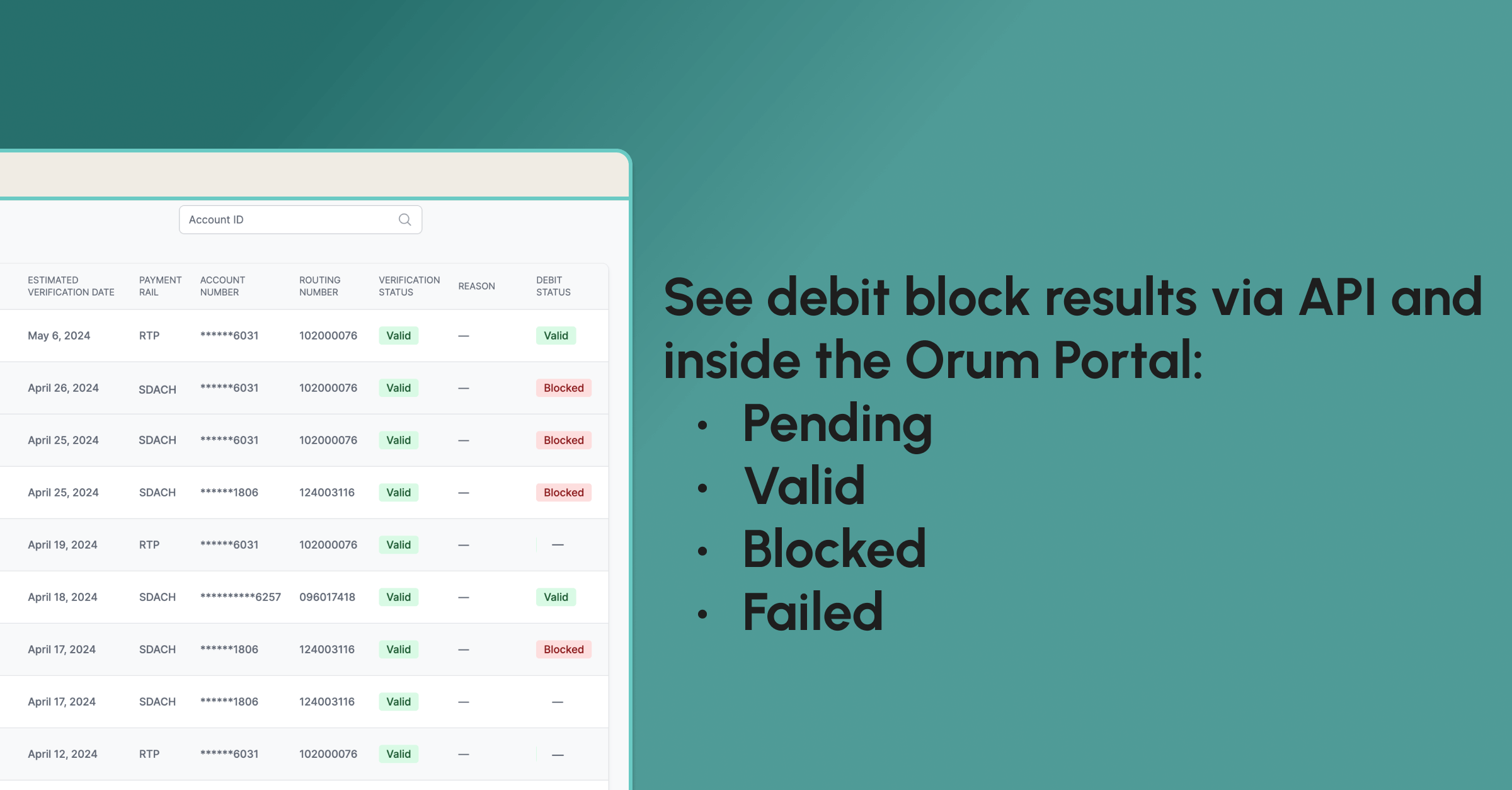

Our Debit Block solution utilizes Same-Day ACH by debiting 1 cent and crediting 1 cent from the user’s bank account. This allows you to know if a debit block is in effect faster than traditional methods, which typically leverage slower systems, and keeps your payments operations running efficiently. You’ll get a response back from the API, and inside the Orum Portal, you’ll also see a new Debit Status, displaying the results of the debit block:

- Pending: The debit block check has been initiated; status stays pending until two business days pass at which point the status updates to Valid, Blocked, or Failed.

- Valid: There is no debit block on the account, which you’ll know within two business days of initiating the process.

- Blocked: There is a debit block on the account, which you’ll know within two business days of initiating the process.

- Failed: There is no debit block on the account, but the transfer failed for some other reason.

Ready to Learn More About Debit Block?

Get in touch with Orum today. We’ll help you get set up with Debit Block in just a few days, without costly bank integrations or prolonged compliance.

More About Verify

Orum’s Verify solution covers 100% of all US-based consumer and business bank accounts — a meaningful step forward in an industry still plagued by invalid credentials, friction, and fraud. The new technology, launched last fall, makes it easy for businesses and banks to verify the status of any type of bank account.